Inflation in the U.S. may look tame right now, but according to a number of new reports, that could change very quickly the longer U.S.-China trade tariffs stay in place. This could be constructive for gold demand, as the yellow metal has helped investors preserve and grow capital in times of rising consumer prices.

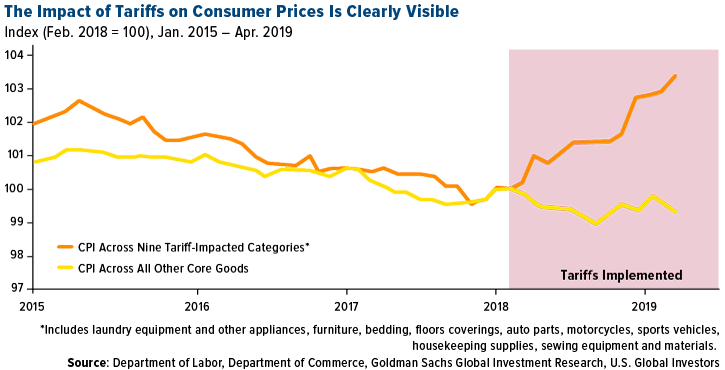

In a recent note to investors, analysts at Goldman Sachs revised up their estimates of the impact tariffs might have on U.S. inflation. Look at the chart below. Although prices for total consumer goods—as measured by the consumer price index (CPI)—have declined over the past few years, prices for as many as nine separate categories hardest hit by tariffs have surged since the U.S.-China trade war began in early 2018.

In May of this year, President Donald Trump raised tariffs from 10 percent to 25 percent on $200 billion worth of Chinese imports. If tariffs were imposed on an additional $300 billion, which Trump has threatened to do, inflation would rise “noticeably” above 2 percent next year, Goldman says. This would “slightly increase the likelihood” that the Federal Reserve would hike interest rates.

It should be pointed out that such tariffs are not generally paid by Chinese exporters. Instead, they are paid by U.S.-based importers, which often pass the extra expense on to the end consumer.

Independent research firm Cornerstone Macro also weighed in on the subject in a note dated May 21, writing that tariffs are just one part of the inflation story right now—the other being rising fuel costs.

“Tariffs, coupled with rising gasoline prices, represent a double whammy for U.S. consumers,” the firm writes. It projects prices for gas and consumer goods to be up some 5 percent year-over-year in the second half of 2019.

It May Be Time to Consider Adding Gold

With inflation potentially on the rise, now may be a good time for investors to consider adding to their gold bullion and gold mining exposure.

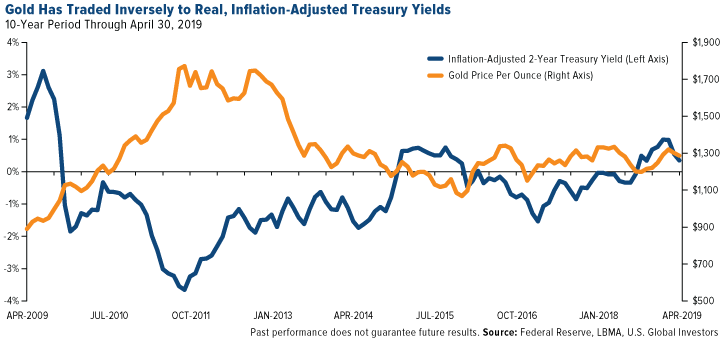

To see why, let’s take a look at the chart below, which compares the price of gold—using the London bullion market’s fix price—and the real yield on the two-year Treasury bond. “Real,” in this case, means that it’s adjusted for inflation year-over-year. Almost immediately you should be able to see an inverse relationship. When the Treasury yield ticked up, the gold price was under pressure. And when the yield fell—especially below zero—gold was supported.

Inflation is a huge factor here. Remember, we’re looking at the real Treasury yield. If the two-year T-year is trading at 0.21 percent, and inflation is running at 3.9 percent, you’re underwater by nearly 3.7 percent. No one wants a negative yield if they can help it.

We saw those percentages, by the way, in September 2011—the same month when gold hit its all-time high of $1,900 an ounce. U.S. Treasury bonds and gold have both been sought as perceived “safe havens” in times of economic or geopolitical uncertainty, but when bond yields have plunged into negative territory, investors’ demand for gold has picked up.

The real two-year yield fell to a nearly flat 0.3 percent in April after dipping lower every month straight since November 2018. Will it turn negative? There’s no telling, of course, but if you believe it is, boosting your allocation to gold might make sense.

Another Way to Participate

A couple of drawbacks to owning physical gold is that it doesn’t yield or produce anything, and you need to pay to store it somewhere.

If that doesn’t sound appealing, another way to get access is with gold miners, but even then, it might be difficult to decide which companies to invest in.

One of the best ways to gain exposure to the gold space, we believe, is with the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). The fund provides access to companies engaged in the production of precious metals not only through active means—mining, for instance—but passive means as well. That includes gold and precious metal royalty companies, which provide upfront cash to producers to develop a project. In return, they receive royalties or rights to a “stream,” an agreed-upon amount of gold, silver or other precious metal at a lower-than-market price.

We believe this is a superior business model, which is why 30 percent of GOAU is weighted in gold royalty names. These companies have exposure to precious metals but have managed to remain profitable even when prices are down, due to strong balance sheets and attractive portfolios of active mines. And because they’re not directly responsible for building and maintaining mines and other costly infrastructure, huge operating expenses can be avoided. They also hold highly diversified portfolios of mines and other assets, which helps mitigate concentration risk in the event that one of the properties stops producing. As a result, royalty companies have enjoyed a much lower breakeven cost than traditional miners.

Compared to many other companies in the mining space, royalty companies have tended to be better allocators of capital, taking on very little debt and deploying cash reserves only at the most opportune times.

To learn more about the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), click the link below!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The consumer price index (CPI) is an index of the variation in prices paid by typical consumers for retail goods and other items.

The LBMA Gold Price is the global benchmark price for unallocated gold delivered in London.