A little over a century ago, Captain John Alcock and Lieutenant Arthur Whitten Brown became the first people to make a nonstop, transatlantic flight. Beginning in Newfoundland and ending with a nonfatal crash landing on the west coast of Ireland, the trip took some 16 hours in a World War I bomber, at an average speed of 120 miles per hour.

At the end of this month, if all goes according to plan, history will be made once again when a jet powered by 100% sustainable aviation fuel (SAF) will cross the Atlantic Ocean for the first time ever. Virgin Atlantic, the British carrier founded by billionaire Richard Branson, received permission from the United Kingdom’s Civil Aviation Authority (CAA) last week to fly from London to New York to test the feasibility of using only green jet fuel on long-haul flights. The demonstration is scheduled for November 28.

The Promising Future of SAF

What is SAF? Advocates tout it as a cleaner alternative to traditional jet fuel, pointing to its ability to reduce CO₂ emissions by up to 80%. Produced from various sources such as waste oils, fats and feedstocks, the fuel is considered “sustainable” because it doesn’t compete with food crops or water resources, and it doesn’t cause deforestation.

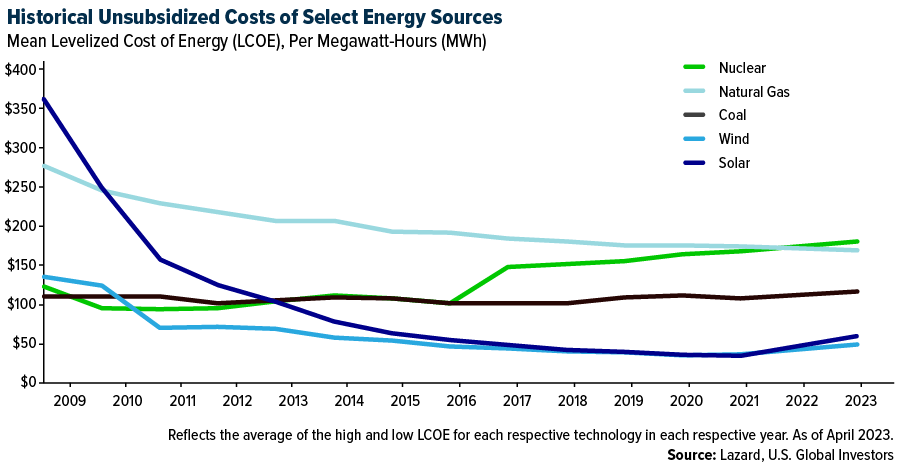

SAF is currently more expensive to manufacture than conventional kerosene, but as is the case with many other alternative energy technologies, scaling up is key to lowering costs. Take solar energy. The technology was once so prohibitively expensive, it could only be used on satellites, but in 2020, the International Energy Agency (IEA) proclaimed it the “cheapest electricity in history.”

With production volumes rapidly increasing, SAF is poised to become a primary tool in helping the commercial aviation industry achieve net-zero emissions by 2050, according to the International Air Transport Association (IATA). Last year, between 300 and 450 million liters (approximately 80 to 118 million gallons) of SAF are believed to have been produced, a 200% to 350% increase from 2021 and as much as a 1,700% increase from 2019. Responding to the Biden Administration’s challenge to produce 3 billion gallons of SAF by 2030, London-based Shell said it would begin ramping up supply for the U.S. market.

How BWB Designs Are Shaping More Sustainable Aviation

SAF isn’t the only technology that companies are eyeing to improve efficiency. A new aircraft design, one that some people describe as resembling a manta ray, could become part of the global airline fleet sooner than expected.

Known as a blended wing body (BWB), this design reimagines the commercial aircraft, doing away with the tubular fuselage and replacing it with a broad, triangle-shaped body. The layout provides additional lift and lowers aerodynamic drag by as much as 30%, which in turn cuts fuel consumption in half and reduces emissions and noise.

The BWB concept also offers a potentially more comfortable passenger experience. Because the interior is much wider and roomier than a traditional tube-shaped jet, seating on domestic flights could be spaced out more generously and even arranged with three aisles instead of the usual one or two. The aircraft is currently intended to serve the middle market of the airline sector, able to seat between 230 and 250 people. (The typical Boeing 737, by comparison, can carry between 108 and 215 passengers.)

In August, the U.S. Air Force announced that it was investing $235 million over the next four years into aircraft startup JetZero, which plans to have a full-scale BWB concept ready to test by 2027. The Los Angeles-based company, whose name is a clever play on “net-zero,” was founded in 2021 with the goal of developing “the next generation of sustainable jets.”

Balancing Fleet Growth with Sustainable Goals

Sustainable jet fuel and more aerodynamic aircraft designs are just two examples of investments airlines are making to bring emissions down to zero by 2050. That year, an estimated 10 billion passengers will fly commercially across 22 trillion kilometers (13 trillion miles), significantly adding to greenhouse gases if nothing changes.

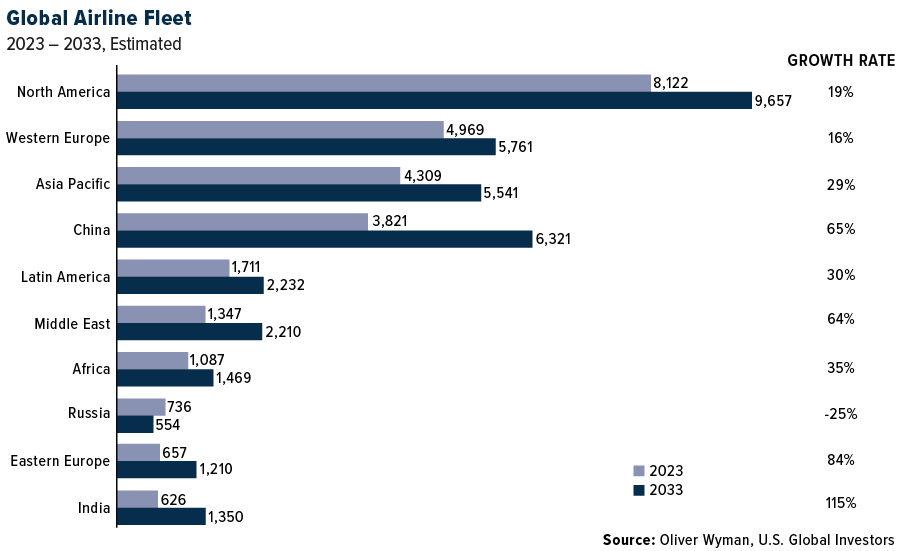

Take a look at the chart below. In just 10 years’ time, the number of commercial aircraft in the global fleet is set to grow dramatically, depending on the market. Consultancy firm Oliver Wyman believes India will more than double the number of commercial jets, from 626 today to 1,350 in 2033. Eastern Europe will also see massive growth, its fleet size expanding by 84%, followed by China (+65%) and the Middle East (+64%). The only market expected to shrink, according to Oliver Wyman, will be Russia, which could see the size of its fleet decrease by 25%, from 736 today to 554 within a decade.

To bring the entire industry into compliance and achieve net-zero emissions, trillions of dollars will need to be spent over the next 30 years to develop more sustainable fuels, more aerodynamic body designs and more efficient operations.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS by clicking here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS.