At the end of September, Delta Air Lines announced that it would buy a 20 percent stake in Chilean carrier Latam Airlines, shaking up a long-time alliance and taking the industry by surprise. This transaction will make Delta the largest shareholder in Latin America’s largest airline carrier.

Why does this news come as a surprise? Last May, American Airlines had unsuccessfully pursued a joint venture with Latam, its fellow Oneworld Alliance member, but the deal was struck down by Chile’s Supreme Court. Taking a different approach to working more closely with Latam, Delta went ahead and purchased a large stake, which will see Latam leave Oneworld and integrate with Delta’s network over the next year. Additionally, Delta has said it will exit its minority stake in Brazilian carrier and competitor GOL, should the transaction be approved by regulators.

American has long been the largest U.S. carrier to the Latin American region, generating more than $5 billion in revenues in 2018, while Delta and United’s revenues of the same area have been less than half that. Although American will remain the largest, Delta’s partnership with Latam will create greater competition in routes between North and South America – at a big cost.

Delta will pay $1.9 billion for the stake, 78 percent above market value, according to the Wall Street Journal. Why pay such a big premium and go after this region that has struggled to stay profitable?

The Investment Case for Latin America

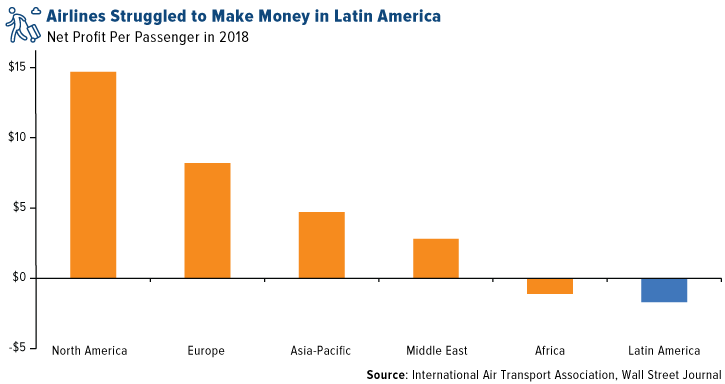

It’s true. Latin America has struggled to be a profitable region for airlines. In 2018, the region ranked dead last in net profit per passenger at negative $1.70. Compare this to the North American average of $14.70 in profit per passenger.

In a May 2019 report, International Air Transport Association (IATA) Regional Vice President of the Americas Peter Cerda says, “Latin America and the Caribbean remain expensive and challenging regions to do business. Unfortunately, many governments continue to view aviation as an industry of the rich and impose heavy taxes and overly restrictive regulations which result in inefficiencies and high cost.” Additionally, the region has seen several currency crises, such as those in Argentina and Venezuela, which can hurt travel demand.

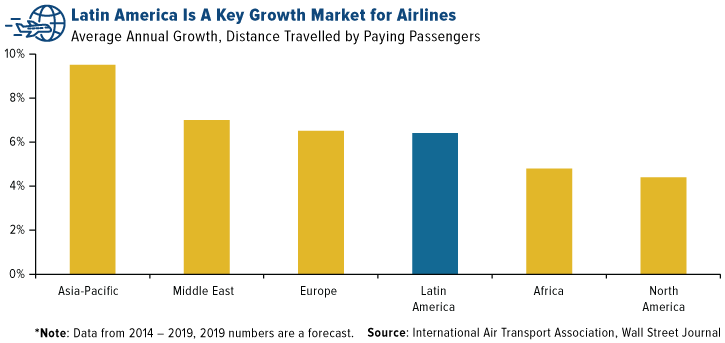

The region is, however, experiencing rapid growth in passenger traffic. Latin America is expected to see an increase of 371 million passengers, or 3.6 percent more, from 2017 to 2037.

Although passenger growth projections trail behind other regions, especially Asia, Latin America is attractive for American carriers due to the closer proximity to North America. In addition to more passengers, they are also traveling farther distances. The region had an average annual growth rate of 6.4 percent from 2014 to 2019, according to IATA.

Traveling farther distances creates the need for longer haul and wide body aircraft. Part of Delta’s deal with Latam will include acquiring four A350 aircraft and Latam’s commitment to buy another 10 A350s to be delivered between 2020 and 2025.

When Alliances Aren’t Enough

Why doesn’t Delta simply partner with Latam and add them to the SkyTeam alliance? Partnerships and alliances help expand global networks and combat economic challenges of entering a new market, but Delta took it a step beyond and into ownership. By purchasing a stake in a carrier, it opens the door for even greater integration of systems and technologies to benefit the customer experience.

Delta is no stranger to expanding its global portfolio as it has large stakes in other carriers, such as China Eastern and Korean Air. It also has a 49 percent stake in both Aeromexico and Virgin Atlantic.

“We are not going to sit around and wait for the alliances to develop their technologies,” Delta CEO Ed Bastian said on its investment-backed deal. The company does still face the challenge of turning around profitability of aviation in Latin America, but growing passenger traffic could attract even more investments.

Wall Street Journal’s Jon Sindreu wrote that “if Delta proves that forging closer links between distant markets can fatten premium-seat margins, its rival may have to respond. The airline industry finally has a chance of going global.”

We believe more major carriers could adopt similar strategies to Delta in growing their global presence.

Invest in the Global Airline Space

The U.S. Global Jets ETF (JETS) invests in the global airline space, including airline operators and manufacturers. Delta is one of the fund’s top holdings and represented 11.40 percent of JETS as of September 30, 2019. The fund also invests in carriers around the world, including the growing Latin America region.

If you’re interested in investing in the airline space, JETS is the only pure-play airline ETF on the market today. Learn how to invest in the fund by clicking here.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.