Gold had a solid start to the decade, rising due to growing geopolitical tension and risks globally, such as the coronavirus, Iran missile attacks and Brexit. Meanwhile, the airline industry remained under pressure, led by news of more trouble at Boeing and the spread of coronavirus halting flights. Click below to read our recap of the airline sector and gold market from January 2020.

Airlines

Gold

Strengths

- London Heathrow, Europe’s busiest airport, has implemented a drone-blocking system to detect threats entering its airspace. The airport had a string of attempts by drones to enter the area in 2019. The new system, designed by France’s Thales SA, can detect and identify drones as far as 5 kilometers away and is already in use at Paris’s Charles de Gaulle airport.

- Delta Air Lines reported stronger-than-expected fourth quarter earnings, with revenue from business cabin tickets and other premium products rising 9 percent. The carrier was boosted by strong ticket sales and robust domestic demand. Delta has benefited from not flying the Boeing 737 Max, which has negatively impacted other major carriers.

- JetBlue increased the cost for travelers checking a first and second bag by $5 to $35 and $45, respectively. Bloomberg reports that other airlines will likely follow suit and raise prices too. JetBlue was the first major U.S. carrier to charge as much as $30 for checking a single bag, and other airlines quickly copied the move. Although negative for consumers, it is positive for carriers in potentially helping boost ancillary revenues.

Weaknesses

- Kyviv-bound Ukraine International Airlines Flight 752 was accidentally shot down by the Iranian military shortly after taking off from Tehran on January 8 – just days after Iran fired more than a dozen missiles at two Iraqi military bases housing U.S. forces. It took several days for Iran to confirm that two missiles struck the plane and said it was due to human error. All 176 people on board were killed and were mostly Canadian or Iranian nationals. The incident led to several countries diverting flights in the area.

- According to internal communications at Lion Air, the Indonesian airline considered putting its pilots through simulator training in 2017 before flying the Boeing 737 MAX, but abandoned the idea after Boeing convinced them it was unnecessary. Just a year later, a Lion Air 737 Max crashed into the sea and killed all on board, partially due to the pilots’ inexperience with the aircraft. This is another big blow to Boeing who sought to prevent pilot training on the new model, as one of the big selling features was that pilots would not need to undergo such training. Bloomberg reports that internal communications at Boeing showed some employees calling Lion Air “idiots” for requesting the expensive simulator training.

- In late January Boeing unveiled the 777X, a twin engine jet capable of flying 426 passengers with wings so long that the wingtips fold. The plane is longer than the 747 and is the priciest model at $442.2 million each. The successful test flight was a bright spot for the troubled plane maker. However, sales of the 777X have stalled since the Dubai Airshow in 2013 and expected orders from China haven’t materialized. Bloomberg Intelligence aviation analyst George Ferguson says “it is feeling like the plane is too big for most markets, for most airlines.”

Opportunities

- Bloomberg reports that the International Air Transport Association (IATA) formed a partnership with Xpansiv CBL Holding Group to develop the Aviation Carbon Exchange, which aims to limit airline emissions. Commercial aviation accounts for 2 percent of the world’s greenhouse emissions and has faced growing scrutiny to adopt greener practices. Xpansiv is an emissions marketplace and saw millions of tons of carbon traded on its platform in January alone. Several airlines have already taken steps to reduce their carbon footprints, with JetBlue announcing that it hopes to become carbon neutral on all domestic flights by July through using an alternative fuel source.

- Norwegian Air is now improving profitability after years of high debt. The airline said its unit revenue rose by 21 percent in December – the ninth straight monthly increase – and 2019 unit revenue was up 7 percent. Bloomberg reports that the company turned around its strategy of aggressive growth and now vows to reduce capacity and focus on profitability.

- India continues to be one of the fastest growing aviation markets and competition is heating up in the country. Singapore Airlines is preparing to add more Boeing jets in India to compete with Emirates. Bloomberg writes that Vistara, which is Singapore Air’s Indian joint venture, is considering adding more 787 Dreamliner jets to add flights to destinations as far away as the U.S. Singapore Airlines is also facing growing competition from budget carriers in Southeast Asia.

Threats

- The biggest threat to emerge for the airline sector in January 2020 was the spread of the coronavirus, declared a global health emergency. In attempting to prevent the disease from spreading further outside of China, many airlines suspended flights to the country for several weeks. This could hurt global travel demand for several months.

- U.K. airline Flybe Group Plc struck a rescue deal with the government to keep the airline from bankruptcy and liquidation, reports Bloomberg. The airline serves more British towns and cities than any other and would leave many routes without flights. Flybe is one of the largest operators of Q400 turboprop planes and employs around 2,400 people. Industry consultant John Strickland says many of the routes have marginal economics and small airports, so other carriers such as British Airways or EasyJet might be hesitant or unable to fill the void due to their larger airplanes.

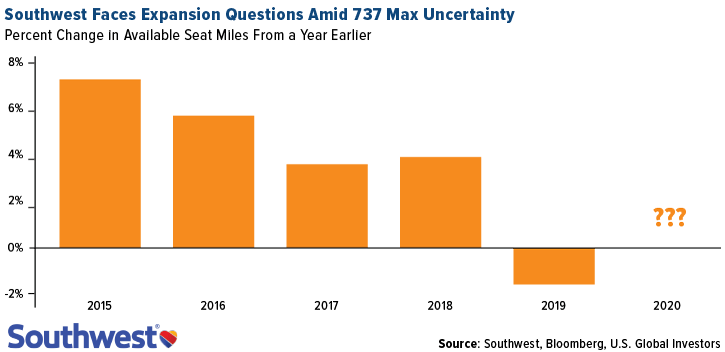

- Boeing’s troubles continue and airlines don’t expect the 737 Max jet to return to service until summer or later. Southwest, which is the most impacted by the groundings because it flies the most jets, said growth has been stalled and didn’t give a 2020 capacity outlook. The airline said in a statement that the cost to fly each seat a mile will increase 6 percent to 8 percent in the first quarter of 2020 due to reduced flights and seat capacity. The carrier reached a confidential settlement with Boeing after incurring $828 million in 2019 damages, reports Bloomberg.

Strengths

- Gold had a second straight monthly gain in January as investors flocked to safe havens amid the global health emergency and the Iran missile strikes. China’s gold imports rose in December to the highest level since April, according to customs data. Total imports of non-monetary gold rose to 146,758 kilograms.

- The number of worker deaths at mines in South Africa fell to the lowest on record in 2019 – a sign that safety is improving in some of the world’s deepest and least-mechanized mines. The Department of Mineral Resources and Energy said in a statement that there were 51 fatalities last year, down from 81 the year prior.

- The Perth Mint reported that gold coin and minted bar sales in December totaled 78,912 ounces – a big jump from November’s 54,261 ounces. BullionVault said the number of first-time precious metals investors using the service grew 25 percent to a two-year high in 2019. The growth was led by clients in the Eurozone.

Weaknesses

- According to the World Gold Council (WGC), purchases of gold jewelry, bars and coins fell by 11 percent in 2019. However, most of that drop was offset by strong central bank and ETF buying. Total gold demand fell just 1 percent from 2018. The WGC also expects gold demand in India to slowly recover in 2020, with demand in the first half of the year likely not showing any significant growth. This follows the worst year for demand out of India in three years amid high bullion prices. Standard Chartered Bank’s Suki Cooper notes that gold jewelry sales out of China could take a hit from the coronavirus, just as it dropped following the SARS outbreak in 2003.

- According to the China Gold Association, gold output in China fell 5.2 percent year-over-year to 380 tons in 2019. Gold consumption also fell 12.9 percent to 1,003 tons. China is the top producer and consumer of the yellow metal globally. Lower demand could be attributed to the number of births falling to the lowest since 1961 and the number of marriages falling to the lowest since 2007.

- Power cuts by South African energy producer Eskom cost Anglo American Platinum 38,000 ounces in lost output in 2019. Power outages forced mines to shut down and impacted production throughout the year. Despite the challenges, total platinum-group metal production grew 9 percent year-over-year to 1.15 million ounces.

Opportunities

- Sibanye could finally pay a dividend for the first time in three years this August. The gold miner acquired Stillwater Mining Co. three years ago and critics said it overpaid for the palladium producer. However, the $2.2 billion investment could now pay off, reports Bloomberg. CEO Neal Froneman said in an interview that the company has almost entirely been de-risked. “I don’t want to be so bold as to say I told you so.”

- BloombergNEF says that mines, especially those in remote locations with high energy costs, can now develop onsite renewable energy as a cost-effective way to reduce carbon emissions and electricity costs. According to BNEF, an off-grid copper mine in Western Australian could use onsite renewables to meet up to 40 percent of its electrical demand at a lower or equal cost to diesel generation. Renewable energy costs continue to fall, with solar down 11 percent and wind down 6 percent in the last year.

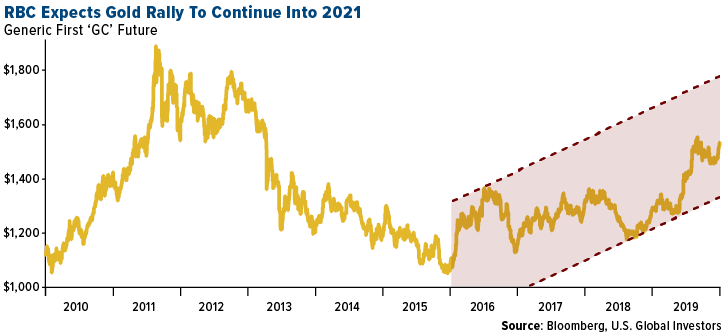

- RBC Capital Markets thinks that the price of gold could tack on another 11 percent to its 19 percent gains over the last year, reports Bloomberg. The bank’s strategists led by Christopher Louney wrote in a note that although gold prices have historically been volatile and could see some fluctuations over the next two years on a quarterly basis, the yearly story could paint a different picture. On a yearly basis, the trajectory is likely higher. And with gold’s rally potentially continuing, silver can also rally further, reports Bloomberg. The two metals are highly correlated, and with a comparative beta 1.3, silver offers greater potential upside.

Threats

- Two of the biggest gold miners are taking different approaches to making shareholders happy. Newmont is focusing on high dividends and improving operations at some of the mines it acquired in its deal for GoldCorp, while Barrick is looking at expanding its copper holdings, which has some shareholders concerned. Barrick has outperformed Newmont in the time since both of their megamergers; however, it will be interesting to see which takes the lead with these different investment strategies.

- Gold producers were hit with a surprise new fee. The Department of Energy issued a mercury fee rule where producers must pay a fee of $37,000 per metric ton of mercury stored. The rule was issued without documents to support its calculations. Gold producers are fighting this new rule, led by Nevada Gold Mines LLC.

- Newcrest Mining said that production at its flagship Cadia operation in New South Wales, Australia could be impacted by the end of this year if the crippling drought continues in the region. The area has seen record low rainfall for the past two years.

Want to receive this recap straight to your inbox? Sign up for monthly updates by clicking here.

Ancillary fees/revenue, in the airline industry, is revenue from non-ticket sources, such a baggage fees and on-board food and services, and has become an important financial component for low-cost carriers.