Gold Appears Well-Positioned In 2023

The price of gold stopped just short of hitting $1,960 an ounce at the very start of February 2023. This is the highest level since April 2022, before plunging below $1,900 on Friday, February 3, following a stronger-than-expected U.S. jobs report, indicating that the current rate hike cycle may be far from over.

We don’t believe that this takes away from the fact that gold posted its best start to the year since 2015. The yellow metal rose 5.72% in January, compared to 8.39% in the same month eight years ago.

We also maintain bullishness for gold and gold mining stocks in 2023. Gold was one of the very few bright spots in a dismal 2022, ending the year essentially flat, and we expect its performance to remain strong in the year ahead.

Record Retail Demand In 2022

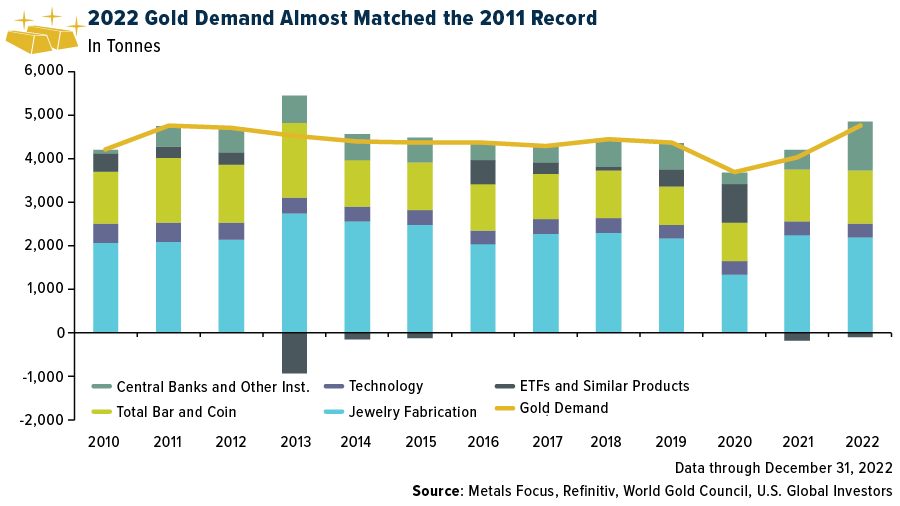

The big headline in the World Gold Council’s (WGC) 2022 review is that total global demand expanded 18% year-over-year, reaching its highest level since 2011.

Central banks were responsible for much of the growth, adding a massive 1,136 metric tons, the largest annual amount since 1967. China began accumulating again in 2022 for the first time in three years, continuing its goal of diversifying away from the dollar.

Meanwhile, retail demand for bars and coins in the U.S. and Europe hit a new annual record last year in response to stubbornly high inflation and the war in Ukraine. Western investors purchased 427 tons (approximately 15 million ounces), the most since 2011.

Will Investors Shift From Physical Bullion To Gold-Backed ETFs In 2023?

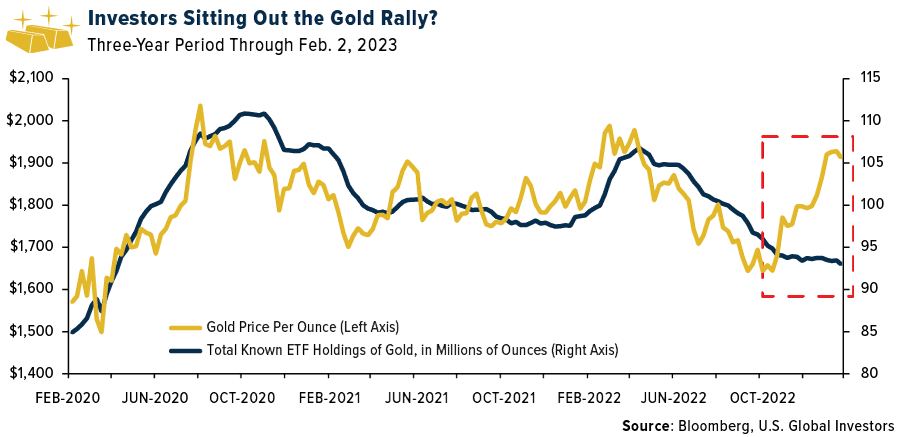

Where we see the opportunity is with gold-backed ETFs and gold mining stocks, both of which didn’t see the same level of demand as the bullion market last year. Investors withdrew some 110 tons from physical gold ETFs, the second straight year of declines, though at a slower pace compared to 2021. Even when the gold price began to climb in November, investors didn’t seem to respond as they have in past rallies.

The WGC suggests that demand for ETFs that hold physical gold will “take the baton” from bars and coins this year. That remains to be seen, but we believe it is best to diversify.

One way for investors to gain exposure to the gold space, is through gold mining and royalty names – both of which can be found in the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU).

To learn more about GOAU, click here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Please carefully consider a fund’s investment objectives, risks, charges, and expenses. For this and other important information, obtain a statutory and summary prospectus for GOAU here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political, or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Fund holdings and allocations are subject to change at any time. Click here to view fund holdings for GOAU.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU.